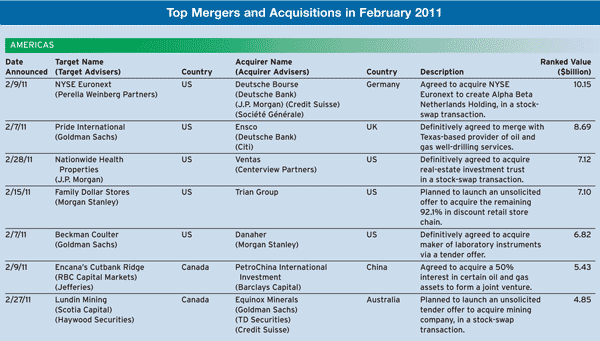

In 2011, the energy and financial services sectors were anticipated to see significant merger and acquisition (M&A) activity, and they have indeed experienced notable developments.

In the energy sector, rising oil prices, geopolitical uncertainties, and lingering effects from the financial crisis have contributed to ongoing volatility. Companies with substantial cash reserves, including those from emerging markets, have been particularly active in pursuing domestic and international acquisitions.

China has notably increased its investment in global energy assets. For example, PetroChina International Investment agreed to invest $5.4 billion to establish a 50-50 joint venture with Canada-based Encana to develop shale gas production. This partnership covers 1.3 million acres in Cutbank Ridge and includes substantial infrastructure for gas processing and storage.

PetroChina has also expressed interest in collaborating with major Canadian oil and gas firms and is exploring opportunities in LNG and oil sands projects in Canada and China.

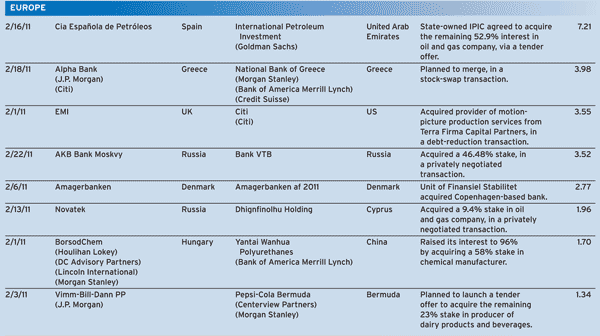

Abu Dhabi’s sovereign wealth fund, International Petroleum Investment Company (IPIC), has expanded its presence in the European energy sector. IPIC agreed to pay $7.2 billion to acquire the remaining 52.9% stake in Spain’s second-largest oil company, Cepsa, from Total and other investors. This acquisition aligns with Abu Dhabi’s strategy to enhance its downstream capabilities, as Cepsa operates refineries, service stations, and petrochemical facilities.

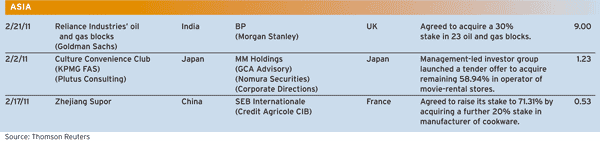

In another significant transaction, BP acquired a 30% stake in 23 oil and gas blocks from Reliance Industries for $9 billion. This move is part of BP’s strategy to shift focus to emerging markets following the Gulf of Mexico oil spill and the ongoing closure of US exploration drilling. BP’s partnership with Reliance extends to a deepwater project off the east coast of India, and the company also holds a 71% stake in Castrol India.

In the financial services sector, significant M&A activities have been prominent. Proposed mergers among major global stock exchanges have captured attention, and several bank mergers are underway.

In Greece, the National Bank of Greece made an unsolicited all-share offer valued at approximately $4 billion to acquire Alpha Bank. Alpha Bank rejected the offer, citing concerns over the current economic environment and unfavorable terms for its shareholders.

In Russia, Bank VTB acquired a 46.5% stake in AKB Bank Moskvy (Bank of Moscow), with plans to eventually acquire 100% of the bank. Bank of Moscow is closely linked to the Moscow city administration and was previously associated with the former mayor Yuri Luzhkov, who was dismissed last September.